How can I estimate how much I can earn?

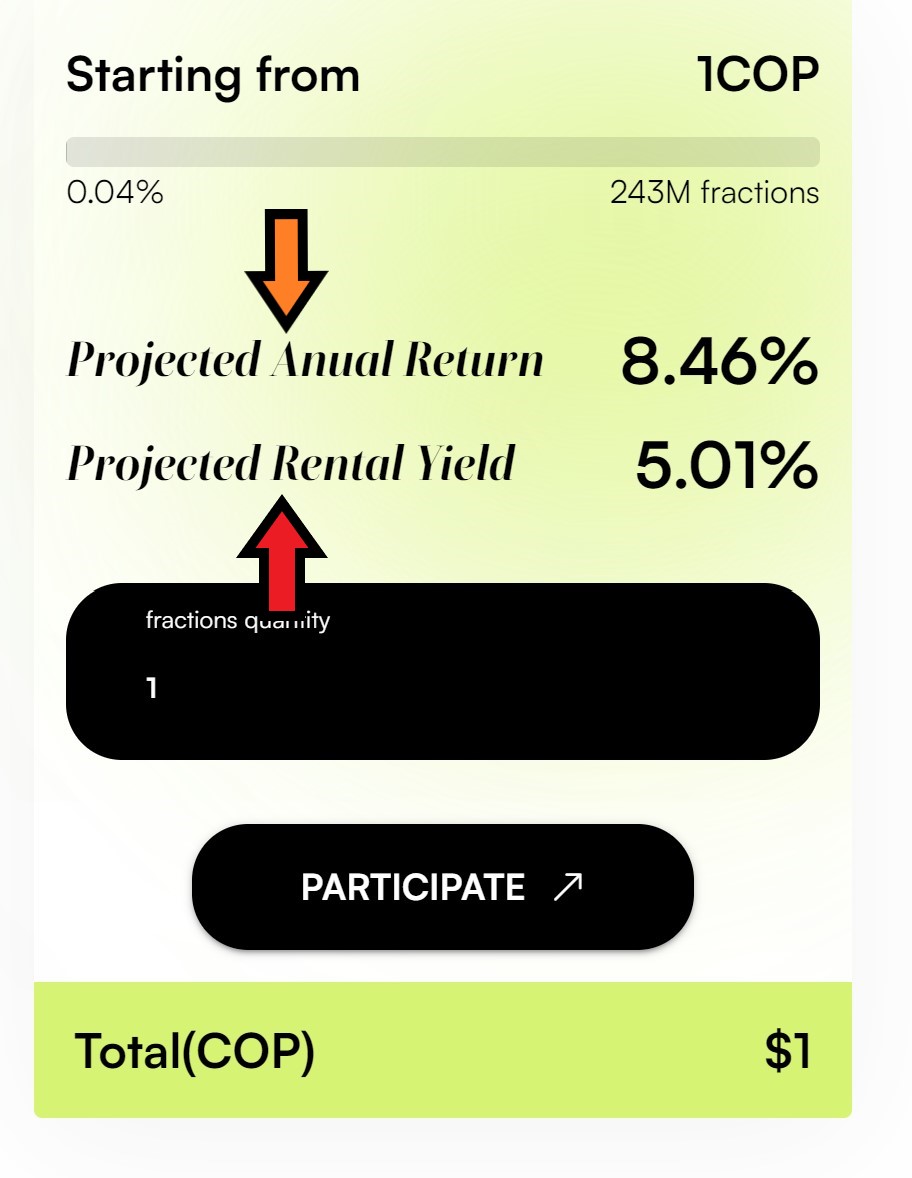

At LaProp, our products typically provide key financial information to better understand their financial aspects. This section also displays the estimated percentage of return both in rental income and appreciation. For example:

In the following image, you'll find two important pieces of information. On one hand, there's the estimated/projected annual rental income (red arrow). This is the estimated annual percentage you'll receive in rental income based on your investment. For instance, if this value is 5.01%, it means that for every 100 dollars invested, you'll receive approximately 5.01 dollars at the end of the year in rental income.

On the other hand, we have the estimated/projected annual return (orange arrow). This indicates the total return on investment for a year, which includes the projected annual rental income return. This means that the investment consists of two parts: the appreciation of your fraction and the rent you receive from it. In this case, if the annual return is 3.45%, it means that the value of your fraction will increase by approximately 3.45% in one year. Following the previous example, if you invest 100 dollars in this product, the value of your fractions would increase to 103.45 dollars in one year, which equals a total investment return of 108.46 dollars.

However, it's important to note that the investment also depends on the currency in which the product is denominated. In this case, we have used dollars as an example for greater simplicity and international understanding. However, each product pays in the currency it is set in on the website. This means you should also consider possible fluctuations between different currencies.

Can I simulate my investment in any way?

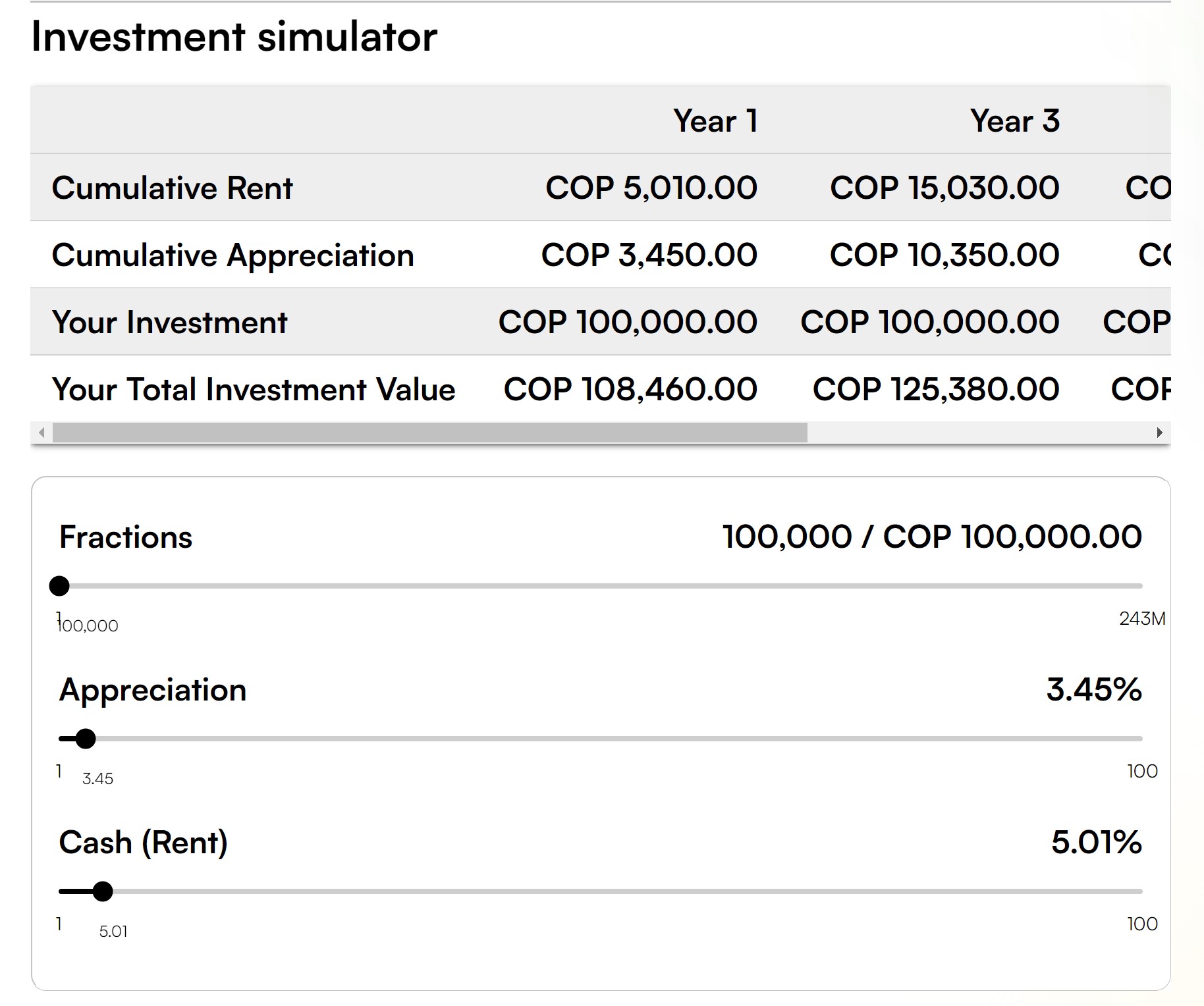

Yes, you can simulate your investment using the investment simulator available for each product. This simulator allows you to estimate how much you could generate if you invested a specific amount, based on projected returns and appreciation. For example, in the following image, you can see how your investment would behave if you invested 100,000 COP over the next few years.

Additionally, it's important to mention that we have three key variables displayed in the table. These values are presented over time in periods of 1, 3, 5, and 10 years:

-

Cumulative rent: This figure shows the income generated from rents.

-

Cumulative appreciation: This figure represents the income generated from the appreciation of the asset's value.

-

Your initial investment: This figure indicates the amount you initially invested.

-

Total value of your investment: This is the sum of the accumulated rent and the accumulated appreciation.

The simulator allows you to adjust variables according to your preference, in case you want to explore specific scenarios.

It's important to note that the simulator does not take into account any kind of increase due to inflation or other variables present in real estate projects (change of ownership, defaults, extraordinary appreciation, etc.). Therefore, it's a linear estimation and should be interpreted with caution when making investment decisions.

I'm a bit confused with the variety of currencies!

We understand your concern and apologize for any confusion this may cause. We are actively working on finding a way to display a single currency when investing. It's important to consider that displaying all investments in a single currency could be confusing due to market fluctuations, which could lead to misunderstandings. We are evaluating possible solutions to address this issue. If you have any recommendations or ideas regarding this, please feel free to share them with us.